New Money Games

New Money Games – How much more money do you think you could save if you played money saving games? How to have fun saving money with adult games, including money saving challenges.

In fact, I have a slight suspicion (but can’t find any statistics to back it up) that if you make saving money FUN. In fact, it will increase the amount you save.

New Money Games

Not only am I having tons of fun with the adult savings games below, but you better believe I’ll be playing with you (Rainbow Savings Game has my name on it!).

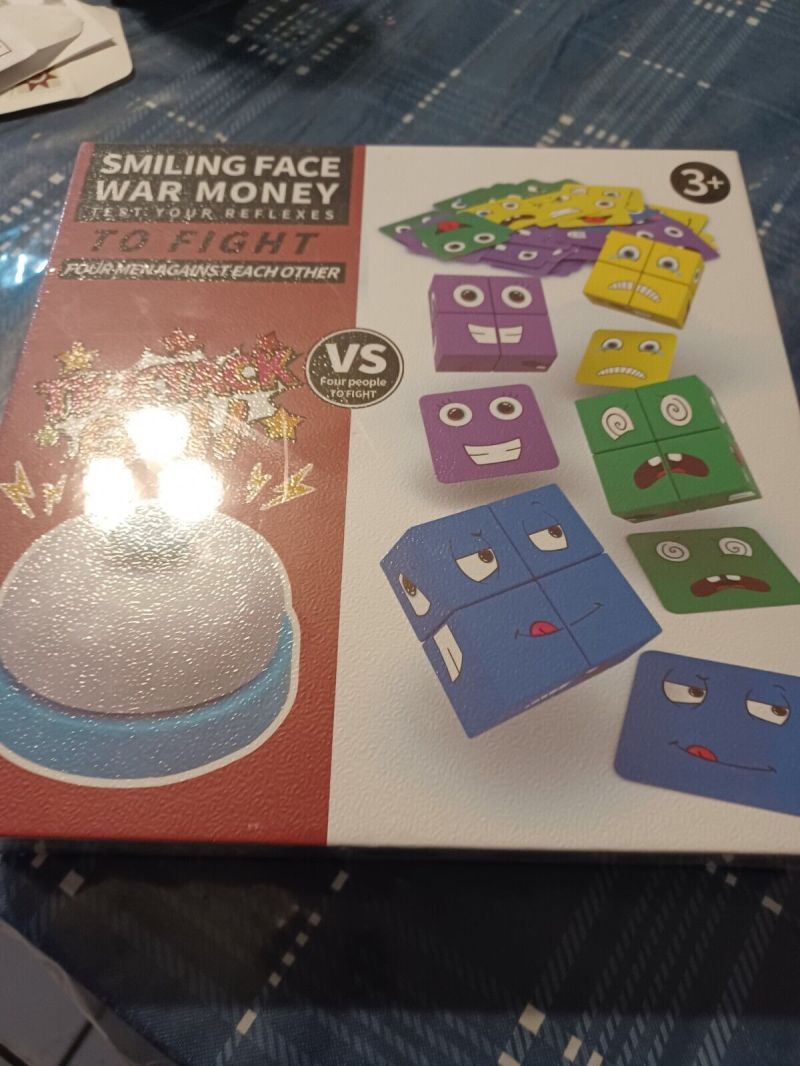

The Best Educational Money Games For Kids

I have tons of adult savings games to help you grow your savings account.

Pick one or two of them to play next month? And you’ll be surprised at the progress you can make.

Psst: Not quite sure what savings goal to have? Be sure to check out my article on 47 AMAZING Things You Can Save On. 1. Play the Rainbow Saving Game

Grab a bag of skittles (or other colorful candies) and drop them into a mason jar, cereal bowl, or whatever else you already have.

Play Money For Board Games

Then grab this free rainbow printable (you’ll need to download it first, no registration required, and then you can print it out). Enter your savings goal in the pot of gold box. Determine a color for each of the rainbow stripes and assign an amount of money to each color.

Every week, close your eyes and choose a Skittle. So much money you have to figure out how to save

Start on a Sunday evening and set a deadline for achieving this goal the following Sunday evening (say 5:00 PM).

If you reach your goal? Then you can draw a circle to represent the candy in the corresponding color of the rainbow (then of course

Best New Online Real Money Slots In April 2022

Psst: another cool way to do it? Get cheap bingo markers in a variety of colors to match the pins. Then simply ‘tap’ to color the rainbow as you complete each challenge assigned to you! 2. Play a game with yourself 40% savings Head

I do it when I run. I commit to running a certain distance (say 1 mile) and then as I approach that mile I only think about one more quarter turn (one more pole if I’m out).

When I finish that quarter turn (or to the next bar)…then I do one more. I usually do this 3-4 times and end up making 25% more progress than I thought I would.

Navy Seal David Goggins actually calls it the 40% rule, which means that every time we do something, we only do 40% of our capacity. In fact, we still have 60% left waiting to be released!

Master P To Release Video Game Set In New Orleans

Practical application: Take your savings goal and add 60% to it. How does it feel? For example, if your goal is to save $5,000, then an additional 60% will increase your actual savings goal to $8,000. Gentlemen! Trying to save up to $500? Your actual savings goal after using the 40% rule should be $800.

Psst: Looking for ways to save money AND have fun in other areas of your life? Be sure to check out my articles on 74 things you can do with friends for free and 365 ways to reward yourself for $5 or less. 3. Follow the trail of cookie crumbs

I created this phrase about 6 years ago for a debt course I created and it can also be used as a money saving game.

Just take a sheet of paper and build a game plan (also great as a bullet journal saver idea). Each block is worth a certain amount of money that you have to save before you can move towards it.

Top 5 Real Money Online Casinos Of 2023

Here’s the key: Create milestones in the board game and the reward you get for completing each milestone.

In my example, you would follow the cookie crumbs to each piece of cookie and finally to the big-kahuna cookie itself!

And your rewards? Well, you don’t have to be put off your savings goals course. That’s right, I have 365 ways to reward you for $5 or less.

I love healthy competition: I am competitive by nature. What if I can challenge myself with something? Then you are much more likely to achieve your goal.

Money Games: Profiting From The Convergence Of Sports And En

That’s why I’m including a whole section on money-saving challenges (don’t have a lot of money? You’ll definitely want to check out these 9 mini money-saving challenges or daily money-saving challenges for small budgets). Because for many of us adults, it adds a HUGE element of fun to our money management!

Tip: Here’s a resource for starting a money-saving challenge and 9 awesome challenge ideas to help you make it better (and easier). 4. Weekly Savings Challenge collect 52 cards

I’m excited to introduce my new twist on the 52-week savings trend – the 52-Card Weekly Savings Challenge!

You’re in control of how much you save over the next 52 weeks simply by assigning a cash value to each type of card in the deck. As you save this amount, you will cross it off your handy checklist. After 52 weeks? You will reach your savings goal!

New Edition Big Business State Game

Psst – here are more 12 month savings challenges for you to try. 5. Take the End of Bill Savings Challenge (aka BANK IT)

This occurred to me a few years ago when I finally realized that the “thrift” stores telling you what you have at the bottom of your receipts are not actually savings in the truest sense of the word.

I mean, if you go to CVS and see that you saved $15.36 at the end of your receipt… are you really $15.36 richer? No. Not unless you “save” it.

In this Bank It game, you have to bank every receipt you get that you have savings on at the end (through manufacturer coupons, store coupons, store sales, etc.).

New Drug: Real Money Games

So in this example, I would put $0.63 into my jar or savings account (… I could round it up to $1.00):

This is pretty fun! Because you start to connect your coupons and other efforts with real money back in your own pocket.

Not only that, but it also helps you “reset” your budget. This means that instead of “saving” a large amount of money for shopping and then going out and spending it elsewhere, you instead keep the same original budget but redirect that money into savings.

Paula from Afford Anything challenges you to save just 1% more of your income than you currently save. And then every month you add another 1% of your income to those savings.

Unreal Engine Is Now Royalty Free Until A Game Makes A Whopping $1 Million

Well, do it for yourself. Make a matching contribution of $0.50 or $1.00 for every dollar you save. Or, save a matching percentage/amount for every dollar you spend on your discretionary expenses (you know, the expenses that just “happen” during the month, like an unexpected trip to the movies or a car ride).

We’ve all heard the “rule” that you should save 10% of your salary every year… but how many actually do it?

Take the time to figure out what percentage of your salary you save each year. Is it less than 10%? I challenge you my friend to increase it to at least 10%.

Is it already 10% or more? Then go back to the top 1% challenge and start with it.

Game Center Overview

Or have you found that you are saving 10% of your salary but not your gross salary? Then increase it to 10% of your gross pay (that is, your pay before anything is deducted from it).

What do i like to do It cuts my timeline in half. Right at the beginning. It always amazes me how quickly I can get to something or do something just because I suddenly decided to spend less time on it (called scalable consumption).

Practical application: Take your savings goal and double it. Take as long as you want to achieve this and cut it in half. What is your goal now?

Psst: Not sure how to set a savings goal? Here’s an example we did: our honeymoon savings goal. 10. Take Jerry Seinfeld’s challenge and save money

Playstation Plus Review: Premium, Extra And Essential

Jerry Seinfeld came up with a great and simple system to challenge himself to write every day of the year: he just has a calendar on his wall and can put an “X” on each day he writes.

He says the incentive to keep the “X” chain going as long as possible is pretty big.

You might not be able to save the kind of money you’d like to in real life (*raises hand*). Or maybe you love money games.

Either way, another category of money saving games for adults is found in financial board games for adults.

New Money Games

Robert Kiyosaki, author of Rich Dad Poor Dad (an excellent read by the way) came up with the board game Cashflow.

It’s a fun way for adults to understand the value of not only saving money, but also investing it.