11 1: Describe Capital Investment Decisions and How They Are Applied Business LibreTexts

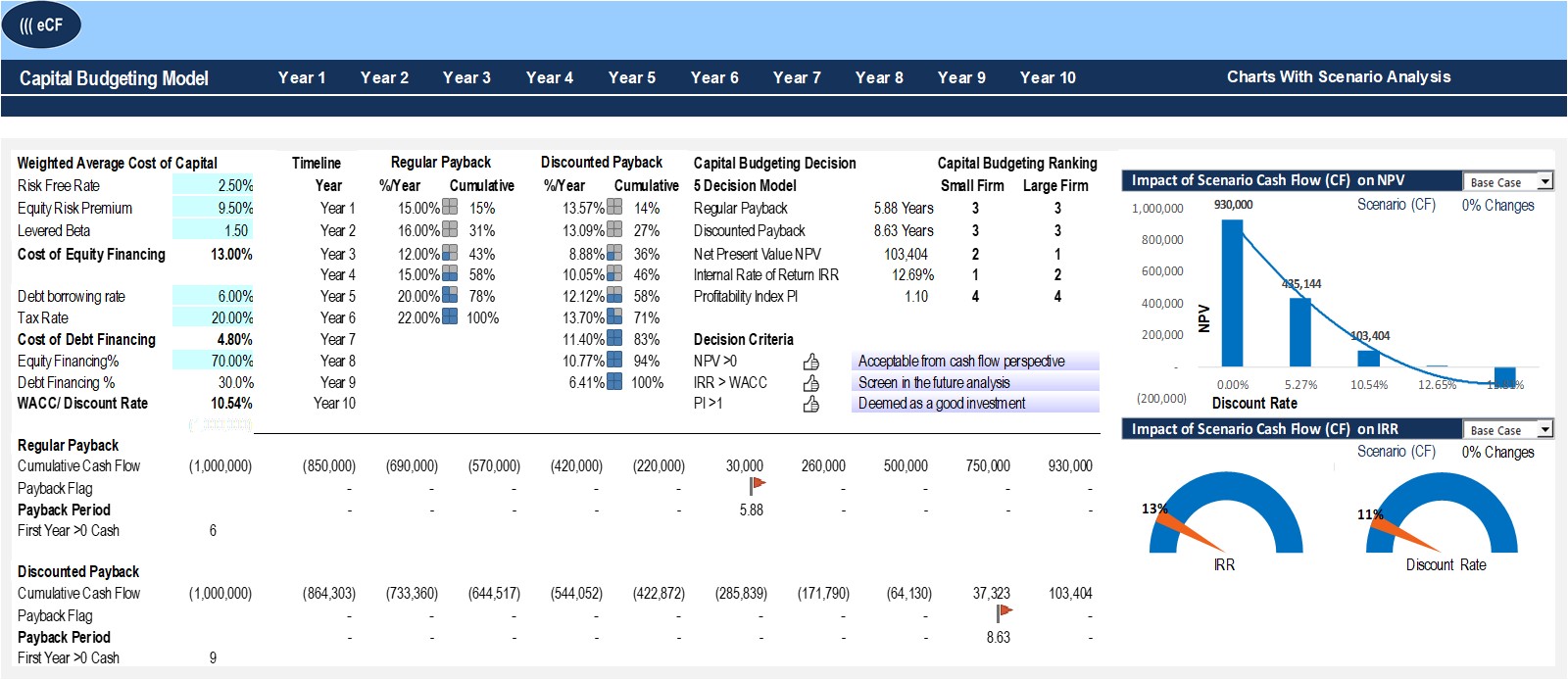

In column C above are the discounted cash flows, and column D identifies the initial outflow that is covered each year by the expected discount cash inflows. A screening decision capital lease vs operating lease is made to see if a proposed investment is worth the time and money. A preference capital budgeting decision is made after these screening decisions have already taken place.

Capital Budget Projects

The advantage of the internal rate of return over the payback method or the simple rate of return method is that IRR considers the time value of money. The major disadvantage is that IRR only works for investments with a single cash investment at the beginning and constant cash flows over the life of the investment. Many capital budgeting projects require multiple investments at different times during the project and produce uneven cash flows over the life of the investment. Most capital budgeting methods prioritize the use of cash flows over accrual accounting numbers. The cash payback period, net present value method, and internal rate of return formula are examples of techniques that focus on expected cash flows from projects.

The Difference Between a Capital Budget Screening Decision & Preference Budget

The capital budgeting process is a structured approach to evaluating and selecting long-term investments that align with a company’s strategic goals. This process starts from coming up with concepts from different parts within the organization such as the senior management or departmental heads among others. These suggestions go through a thorough scrutiny where managers predict cash flows, study costs and revenues so as to ascertain their workability. Additionally, this should not be viewed as an isolated event but rather an ongoing series of actions taken even after projects have been approved.

Practice Video Problem 11-1: Payback period, simple rate of return, and internal rate of return LO1, LO2, LO3

In selecting a project based on the Payback period, we need to check for the inflows each year and which year the inflows cover the outflow. The net present value for both the projects is very close, and therefore taking a decision here is very difficult. Ultimately, the main goal is to make smart decisions that will help the business grow and remain strong. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Ask a Financial Professional Any Question

In capital budgeting, there are a number of different approaches that can be used to evaluate a project. Two very common methodologies of evaluating a project are the internal rate of return and net present value. However, each approach has its own distinct advantages and disadvantages. Here, we discuss the differences between the two and the situations where one method is preferable over the other.

So, the company must decide whether or not to invest in the machine by comparing the initial investment to the expected future cash flows. If the expected cash flow is greater than the initial investment, then logically, the company should invest in the machine. By analyzing potential investment decisions through a strict process, businesses can ensure they make decisions that align with their long-term plans.

- In this case, if you add up the yearly inflows, you can easily identify in which year the investment and returns would close.

- This isn’t just for large corporations; even small companies, like ones that handle small company payroll services, use capital budgeting.

- The standard model requires maintenance service in year 2 and year 4 at a cost of $2,100 per service.

- Many use existing accounting software to help track and manage projects and investments, while others stick to more conventional methods of spreadsheets.

Second, due to the long-term nature of capital budgets, there are more risks, uncertainty, and things that can go wrong. Capital budgeting is a useful tool that companies can use to decide whether to devote capital to a particular new project or investment. There are several capital budgeting methods that managers can use, ranging from the crude but quick to the more complex and sophisticated. IRR only uses one discount rate, and the true discount rate can change substantially over time – especially if the investment is a long-term project.

The payback period is calculated as the investment required divided by the annual net cash inflow from the project. The data in Exhibit 11-2 gives net operating income, which includes deprecation expense. When net operating income is provided, depreciation expense is added back to arrive at net cash inflow. The payback period is the length of time that it takes for a project to recover the initial cost from the net cash inflows generated by the project. The formula to compute the payback period considers the investment required and the annual net cash inflow from the investment.

0 comments